Silicon Carbide Laser Crystals: The 2025 Revolution Investors Can't Afford to Miss

Table of Contents

- Executive Summary: 2025 at a Glance

- Global Market Forecasts & Growth Drivers (2025–2030)

- Key Players and Industry Alliances (Official Sources Only)

- Technology Innovations: Advanced SiC Crystal Growth Methods

- Cost Structure, Supply Chains & Raw Material Sourcing

- Use Cases: Laser Applications Across Industries

- Competitive Landscape & Barriers to Entry

- Sustainability Initiatives and Regulatory Outlook

- Investment, M&A, and Funding Trends

- Future Outlook: Strategic Opportunities & Disruption Risks

- Sources & References

Executive Summary: 2025 at a Glance

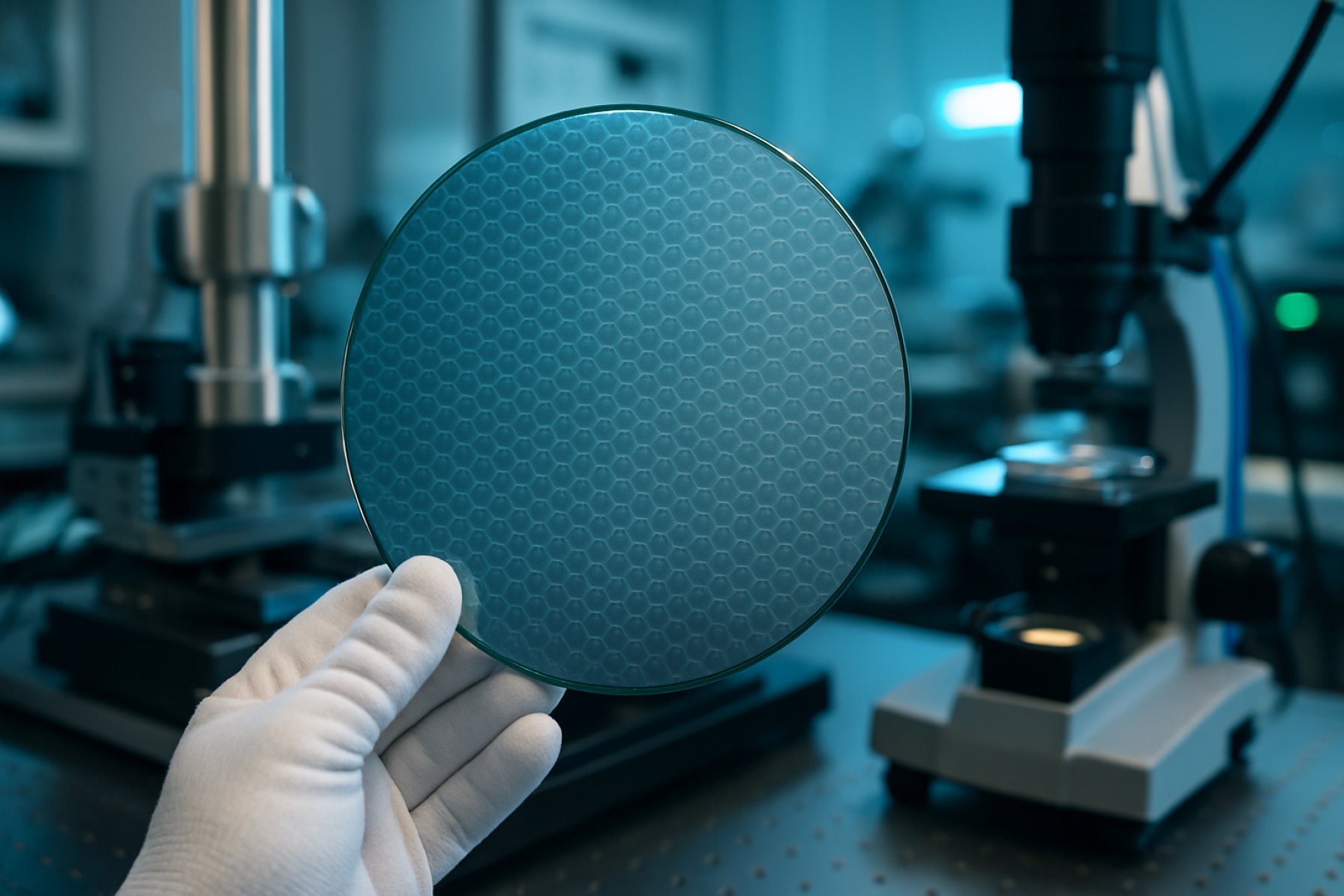

The manufacturing landscape for silicon carbide (SiC) laser crystals in 2025 is characterized by accelerating technological innovation, strong demand growth, and intensifying investment in crystal quality and scale-up. SiC’s unique material properties—high thermal conductivity, wide bandgap, and robust mechanical strength—continue to drive its adoption in high-power and wavelength-specific laser applications, with the semiconductor, defense, and quantum photonics sectors at the forefront.

Over the past year, industry leaders have advanced both the bulk growth techniques (such as Physical Vapor Transport, PVT) and post-growth processing capabilities. Cree | Wolfspeed and Coherent Corp. (formerly II-VI Incorporated) have reported progress in scaling up the size and quality of SiC boules, targeting not only the power electronics market but also specialty applications including laser gain media. In parallel, manufacturers such as HexaTech are leveraging proprietary growth methods to improve crystalline uniformity and reduce defect density—key metrics for laser performance and longevity.

On the application side, 2025 is witnessing SiC laser crystals transition from R&D into commercial prototype deployments. The automotive LiDAR, satellite communications, and quantum computing segments are actively evaluating SiC-based gain media for their ability to sustain high optical powers and operate at wavelengths inaccessible to conventional materials. Partnerships between laser system integrators and SiC crystal fabricators, such as those announced by TRIUMPH LASER and leading optical component providers, signal a robust downstream pull for high-spec SiC crystals.

Industry data suggest that the global installed capacity for SiC crystal growth will increase by over 25% in 2025, driven by investments in new reactors and automation. However, challenges persist in cost reduction, yield improvement, and the transition to larger-diameter wafers. Efforts by ROHM Semiconductor and Showa Denko K.K. on substrate engineering and defect mapping technologies are expected to play a critical role in overcoming these hurdles.

Looking ahead, the outlook for SiC laser crystal manufacturing is one of cautious optimism. While technical barriers remain, the convergence of end-user demand, capital inflows, and process innovation points toward sustained double-digit growth through the next several years. Collaboration across the value chain—spanning crystal growers, equipment suppliers, and laser system manufacturers—will be key to accelerating SiC’s role in next-generation photonic systems.

Global Market Forecasts & Growth Drivers (2025–2030)

The global market for silicon carbide (SiC) laser crystals manufacturing is poised for robust growth between 2025 and 2030, driven by expanding applications in photonics, power electronics, and quantum technologies. SiC’s unique wide bandgap, high thermal conductivity, and radiation hardness have made it increasingly attractive for the development of advanced solid-state lasers, particularly those operating in harsh environments or requiring high output power.

Leading manufacturers such as Cree, Inc. (now Wolfspeed), Coherent Corp. (formerly II-VI Incorporated), and HexaTech have expanded their production capacities and R&D efforts, anticipating surging demand from industrial, military, and scientific sectors. Wolfspeed, for instance, continues to invest in its Mohawk Valley Fab, the world’s largest SiC device manufacturing facility, which is expected to bolster supply chain resilience and reduce lead times for SiC substrates and wafers through the late 2020s.

Forecasts for 2025–2030 indicate a compound annual growth rate (CAGR) of approximately 18–22% for SiC crystal manufacturing, with market value expected to surpass $1.5 billion by 2030. This expansion is underpinned by several key growth drivers:

- Laser-based Material Processing: SiC’s durability and thermal management properties are critical for next-generation industrial lasers used in cutting, welding, and additive manufacturing, where operational efficiency and longevity are paramount (Coherent Corp.).

- Quantum and Defense Applications: The use of SiC crystals in quantum photonics, secure communications, and advanced sensing is accelerating, with organizations like Wolfspeed and HexaTech actively collaborating on research and supply for these high-value sectors.

- Automotive and Power Electronics: While not directly tied to lasers, the surge in electric vehicle (EV) adoption and renewable energy systems has catalyzed investments in SiC manufacturing infrastructure, benefiting the broader supply chain and enabling economies of scale for laser-grade SiC substrates (Wolfspeed).

- New Manufacturing Techniques: Advances in bulk crystal growth methods, such as physical vapor transport and modified Lely processes, are expected to increase yields and reduce defect densities, making high-purity SiC crystals more widely available for laser applications (HexaTech).

Looking ahead, the sector is expected to see further consolidation and vertical integration, as companies strive to secure material supply and advance proprietary fabrication technologies. Strategic partnerships between SiC crystal growers and laser device manufacturers will likely shape the competitive landscape through 2030, ensuring a steady pipeline of innovation and capacity expansion.

Key Players and Industry Alliances (Official Sources Only)

The silicon carbide (SiC) laser crystal manufacturing sector in 2025 is defined by the participation of established material science leaders, emerging specialist manufacturers, and strategic collaborations aimed at accelerating advanced photonics innovation. SiC’s unique combination of wide bandgap, high thermal conductivity, and chemical stability positions it as a promising material for next-generation solid-state laser applications, especially in high-power and harsh-environment contexts.

Key players leading the industrial-scale manufacture and supply of SiC substrates, wafers, and crystals include Wolfspeed, Inc. (formerly Cree), which has invested heavily in expanding its SiC crystal growth and wafer fabrication capacities in North America and globally. Their vertically integrated approach—from raw SiC powder synthesis to finished wafer products—places them at the forefront of the supply chain for laser and photonics device manufacturers. Coherent Corp. (formerly II-VI Incorporated) is another major force, offering a range of SiC substrates and epitaxial services, and collaborating with laser system integrators to optimize the material for specific performance metrics.

In Europe, SICCAS (Shanghai Institute of Ceramics, Chinese Academy of Sciences) and NovaSiC have developed proprietary bulk SiC crystal growth technologies, supplying both academic research and industrial customers. NovaSiC, in particular, specializes in high-purity and custom-oriented SiC substrates, supporting R&D projects and early-stage commercial deployments in photonics and laser engineering.

Industry alliances are playing a pivotal role in advancing SiC laser crystal development. The SEMI industry association, through its materials and compound semiconductor working groups, is fostering cross-sector collaboration on SiC standardization, quality control, and supply chain resiliency. Collaborative research projects, such as those coordinated by EPIC (European Photonics Industry Consortium), are connecting material producers with end-users to accelerate the adoption of SiC-based lasers in telecommunications, defense, and medical device markets.

Looking ahead, industry participants are expected to deepen partnerships addressing crystal size scaling, defect reduction, and integration with emerging device architectures. New entrants, including vertically integrated device makers and semiconductor foundries, are anticipated to enter the SiC laser crystal supply chain, further intensifying competition and innovation. As demand rises for higher power, efficiency, and spectral performance in laser systems, the synergistic efforts of these key players and alliances are poised to drive rapid advancements in silicon carbide laser crystal manufacturing through 2025 and beyond.

Technology Innovations: Advanced SiC Crystal Growth Methods

The landscape of silicon carbide (SiC) laser crystal manufacturing is rapidly evolving in 2025, driven by the demand for high-performance materials in photonics, quantum technologies, and power electronics. At the core of this innovation are advanced crystal growth methods that enable production of high-purity, large-size, and low-defect SiC crystals, particularly for laser applications where optical quality is paramount.

One of the most significant technological advancements is the refinement of the Physical Vapor Transport (PVT) technique. Industry leaders such as Wolfspeed and Coherent Corp. have intensified efforts to scale up PVT to produce boules exceeding 200 mm in diameter, while optimizing temperature gradients and gas control to minimize micropipes and dislocations. This directly addresses the challenge of fabricating laser-quality SiC, where crystal uniformity and extremely low defect density are crucial.

Another noteworthy development is the adoption of High-Temperature Chemical Vapor Deposition (HTCVD) for growing ultra-pure, semi-insulating SiC crystals. Norstel AB, now part of STMicroelectronics, is leveraging HTCVD to create SiC substrates with tailored doping profiles. This method is particularly suited to creating the controlled defect environments needed for quantum-grade color centers, which are foundational for next-generation laser and quantum photonics devices.

In parallel, the Lely method and its modifications are being revisited and optimized for specialty laser markets. Companies like TankeBlue in China are investing in proprietary Lely-based processes to achieve high-resistivity SiC wafers targeted at both laser and photonic integrated circuit (PIC) applications.

Looking ahead, research collaborations between industry and academia are accelerating the integration of in-situ monitoring technologies—such as real-time X-ray topography and spectroscopic ellipsometry—into crystal growth systems. This enables precise mapping of defect evolution and compositional uniformity, empowering manufacturers like Wolfspeed to push wafer yields and quality even higher.

Outlook for the next few years suggests a transition from 6-inch to 8-inch SiC wafers in commercial production, with further enhancement of laser-grade material purity and scalability. These advances are expected to lower costs, enable higher-power SiC-based laser devices, and foster breakthroughs in applications ranging from optical communications to quantum computing, positioning SiC as a cornerstone in the photonics materials landscape through the latter half of the decade.

Cost Structure, Supply Chains & Raw Material Sourcing

The cost structure and supply chains of silicon carbide (SiC) laser crystal manufacturing in 2025 are shaped by raw material sourcing, crystal growth processes, and global distribution dynamics. The primary cost drivers stem from the procurement of ultra-high purity silicon and carbon precursors, energy-intensive crystal growth methods, and the precision required for defect-free laser-grade material.

Raw material sourcing is a critical determinant of both cost and quality. The manufacturing of SiC laser crystals relies on highly purified silicon and carbon sources. Major suppliers such as Ferroglobe and Elkem provide metallurgical grade silicon, which is further refined for electronic and optical applications. For laser-grade SiC, purity requirements are often above 99.999%, leading to significant costs in precursor processing and quality control.

The core of SiC laser crystal manufacturing is the crystal growth process, such as physical vapor transport (PVT) and high-temperature chemical vapor deposition (HTCVD). These methods demand specialized reactors, high energy input, and stringent environmental controls. Industry leaders like Cree | Wolfspeed and Coherent Corp. (formerly II-VI Incorporated) have invested heavily in proprietary crystal growth technologies to enhance yield and reduce defect density, thereby improving suitability for laser applications.

Supply chains for SiC laser crystals in 2025 are characterized by vertical integration among leading manufacturers. Companies such as Cree | Wolfspeed and ROHM Semiconductor control multiple stages from raw material purification to wafer and substrate fabrication, ensuring consistent quality and mitigating supply risks. However, the supply chain remains sensitive to geopolitical factors, as silicon production is concentrated in a few countries and the purification processes require rare and highly regulated chemicals.

Recent years have seen increased investment in domestic SiC production lines in the US, EU, and Japan, aiming to reduce reliance on imports and improve supply chain resilience. For instance, Cree | Wolfspeed is scaling up its North Carolina facility, while ROHM Semiconductor has expanded SiC wafer production in Japan.

Looking ahead, industry outlook for 2025 and beyond indicates ongoing efforts to optimize raw material utilization and crystal growth efficiency, as well as to secure diverse and localized supply chains. These strategies are expected to drive incremental cost reductions and support stable, long-term growth in the SiC laser crystal sector.

Use Cases: Laser Applications Across Industries

Silicon carbide (SiC) laser crystals are rapidly gaining prominence across several industrial sectors due to their unique combination of thermal conductivity, wide bandgap, and mechanical robustness, making them well-suited for high-power and high-frequency laser applications. As of 2025, their adoption is especially notable in advanced manufacturing, defense, healthcare, and communications.

In the manufacturing sector, SiC-based laser crystals are enabling more precise and energy-efficient material processing. Their high thermal conductivity allows for continuous-wave (CW) and pulsed laser operation at higher power densities, which is crucial for cutting, welding, and surface treatment of tough materials such as metals and ceramics. Companies like Cree (now part of Wolfspeed) are at the forefront of SiC material innovation, supporting laser system integrators in developing more powerful and reliable industrial lasers.

In defense and aerospace, the demand for robust and compact laser sources is accelerating the integration of SiC laser crystals. Their resilience under extreme conditions and ability to operate at high temperatures make them ideal for applications such as lidar, target designation, and directed energy systems. Northrop Grumman has invested in SiC-based technologies for military-grade laser systems, leveraging the material’s superior thermal management and reliability for mission-critical tasks.

Healthcare is another sector witnessing increased utilization of SiC laser crystals, particularly for medical imaging and surgical procedures. The material’s wide bandgap enables emission in wavelengths well-suited for deep tissue penetration and minimal thermal damage, enhancing the precision and safety of laser-based medical devices. Coherent, a leading manufacturer of laser solutions, is actively researching SiC for next-generation medical laser systems aimed at improved patient outcomes and device longevity.

In telecommunications, the push for faster and more reliable data transmission is driving the adoption of SiC laser crystals in optical communication systems. Their ability to sustain high frequencies and reduce signal loss is critical for high-speed fiber-optic networks and satellite communications. Coherent Corp. (formerly II-VI Incorporated) is developing SiC-based components for photonic applications, targeting the growing needs of 5G and beyond.

Looking ahead, the outlook for SiC laser crystals remains robust across these sectors. Ongoing investments in crystal growth techniques, such as the physical vapor transport (PVT) method and advancements in wafer-scale manufacturing, are expected to drive down costs and improve quality. As companies like Wolfspeed and SiCrystal continue to scale production, SiC laser crystals are poised to become foundational in next-generation laser systems, supporting innovations in manufacturing, defense, healthcare, and communications through 2025 and the years ahead.

Competitive Landscape & Barriers to Entry

The competitive landscape for silicon carbide (SiC) laser crystal manufacturing in 2025 is defined by a combination of advanced materials expertise, high capital requirements, and the need for proprietary process technology. Leading players in this field possess deep vertical integration, from SiC boule growth to wafer processing and precision crystal fabrication. While the broader SiC semiconductor industry has seen a rapid influx of new entrants, the specialized niche of laser-grade SiC crystals remains concentrated among a few technically advanced organizations.

Key competitors such as Cree | Wolfspeed and Coherent Corp. (formerly II-VI Incorporated) have leveraged decades of experience in SiC materials, combined with significant investments in crystal growth equipment, to maintain technological and supply chain leadership. These companies have developed proprietary physical vapor transport (PVT) and high-temperature chemical vapor deposition (HTCVD) techniques to achieve the purity and crystalline perfection required for laser applications. Cree | Wolfspeed announced in late 2023 the expansion of its Durham, North Carolina facility to increase SiC crystal production capacity, underlining the capital-intensive nature of the sector.

Japanese firms, such as Showa Denko K.K., and emerging European players also participate, but face challenges related to intellectual property barriers and the need for ultra-clean processing environments. The high degree of technical complexity—requiring defect densities below 103 cm-2 and precise control of dopants—poses a significant barrier for new entrants, as does the necessity of cleanroom infrastructure, advanced metrology, and long cycle times for crystal growth and qualification.

In addition to technical and capital barriers, access to high-purity precursor materials and reliable supply chains for specialty equipment play a crucial role. Firms that wish to enter the SiC laser crystal market in 2025 and beyond must not only overcome these obstacles, but also demonstrate the ability to scale up production while meeting the stringent requirements of photonics and defense customers.

Looking ahead, partnerships between established materials companies and photonics device manufacturers are anticipated, as end-users seek to de-risk their supply chains and accelerate innovation. However, only organizations with proven expertise in SiC crystal growth and the ability to sustain significant R&D investments are likely to succeed in capturing meaningful share in this highly specialized segment.

Sustainability Initiatives and Regulatory Outlook

The manufacturing of silicon carbide (SiC) laser crystals is evolving rapidly in response to increasing sustainability demands and tightening regulatory frameworks. As of 2025, leading industry players are implementing a range of initiatives aimed at minimizing environmental impact and complying with emerging global standards.

A core sustainability focus is energy efficiency in SiC crystal growth processes. Manufacturers are investing in advanced high-temperature furnaces with improved insulation and heat recovery systems, significantly reducing overall energy consumption. For example, Kyocera Corporation reports advancements in their proprietary SiC growth technologies that cut electricity usage while maintaining high crystal quality. Similarly, ROHM Co., Ltd. is pursuing eco-friendly manufacturing by integrating renewable energy sources into their production facilities.

Water usage is another area of concern, given the substantial water required for cooling, cleaning, and etching during SiC laser crystal fabrication. Companies such as Wolfspeed, Inc. (formerly Cree) have established water recycling and reclamation systems, achieving reductions in freshwater consumption and wastewater generation. These initiatives align with broader industry trends emphasizing closed-loop water systems and zero-liquid discharge approaches.

The use of hazardous chemicals, particularly during wafering and surface treatment, is under increasing scrutiny. As regulatory agencies in the EU and Asia-Pacific introduce stricter controls on chemical emissions and workplace safety, manufacturers are adopting alternative, less toxic chemistries and investing in advanced abatement systems. Coherent Corp. (formerly II-VI Inc.) highlights their compliance with REACH and RoHS directives, and their ongoing R&D into greener etching solutions for SiC substrates.

Looking ahead, regulatory outlooks suggest further tightening of environmental standards, particularly under the EU’s Green Deal and similar policies in the US and China. The trend toward traceability and lifecycle analysis is expected to intensify, with customers demanding transparent reporting on carbon footprint and resource utilization across the entire SiC laser crystal supply chain. Industry consortia and standards bodies, such as the SEMI association, are actively developing guidelines for sustainable practices and responsible sourcing of raw materials.

- Outlook (2025-2027): Widespread adoption of best practices in energy and water management is anticipated, alongside increasing investment in green chemistry and emissions control. Regulatory harmonization and digital traceability solutions will further drive sustainability as a core competitive differentiator in the SiC laser crystal manufacturing sector.

Investment, M&A, and Funding Trends

The landscape for investment, mergers and acquisitions (M&A), and funding in silicon carbide (SiC) laser crystals manufacturing is rapidly evolving as demand for high-performance photonics and power electronics continues to accelerate. In 2025, strategic investments are primarily driven by surging requirements for SiC-based laser devices in defense, telecommunications, and quantum technologies. Major established materials suppliers and device integrators are actively expanding their capabilities and securing access to advanced SiC crystal growth and fabrication technologies.

Recent years have seen a marked increase in capital allocation towards SiC substrate and wafer manufacturing. For example, Wolfspeed announced a multi-billion-dollar investment to construct a new SiC materials facility, with a focus on expanding its capacity to supply high-purity SiC crystals for both electronic and photonic applications. While Wolfspeed’s core market is power electronics, their vertically integrated crystal growth capabilities are critical for laser crystal suppliers seeking high-quality substrates.

Similarly, Coherent Corp. (formerly II-VI Incorporated), a key supplier of engineered materials and laser components, has continued to expand its SiC wafer production footprint through organic investment and targeted acquisitions. Their recent acquisition of Coherent, Inc. strengthened their position in the photonics and laser materials supply chain, enhancing their capabilities to serve emerging SiC laser crystal markets.

In Asia, Shanghai Institute of Ceramics, Chinese Academy of Sciences (SICCAS) remains a prominent producer of novel SiC crystal materials, including those tailored for laser applications. The institute has secured increased state-backed funding to accelerate R&D and pilot-scale manufacturing of large-diameter, low-defect SiC crystals, with the goal of enabling next-generation laser systems and quantum photonic devices.

Looking forward, the sector is expected to witness further consolidation and collaboration. Market leaders are likely to pursue M&A activities to secure intellectual property and talent in SiC laser crystal growth, while new entrants may attract venture funding by demonstrating breakthroughs in crystal purity, defect management, or scalable production. Public-private partnerships will also play a crucial role in fostering innovation and de-risking investment in this capital-intensive field.

Overall, the current investment climate for SiC laser crystals is robust, with significant capital flows, strategic acquisitions, and government support setting the stage for accelerated commercialization and technological progress through the remainder of the decade.

Future Outlook: Strategic Opportunities & Disruption Risks

As the demand for high-performance photonic components accelerates into 2025 and beyond, silicon carbide (SiC) laser crystal manufacturing is poised at a critical juncture, presenting both strategic opportunities and disruption risks for industry stakeholders. SiC’s unique combination of high thermal conductivity, wide bandgap, and mechanical robustness has heightened its status as a next-generation material for solid-state laser applications, particularly in defense, telecommunications, and quantum technologies.

Key manufacturers are scaling up investments in crystal growth technologies, such as physical vapor transport (PVT) and chemical vapor deposition (CVD), to address yield and quality constraints. Coherent Corp. continues to develop advanced boule growth and slicing techniques aimed at producing larger, defect-reduced SiC crystals suitable for high-power laser hosts. Meanwhile, Wolfspeed (a Cree company) is expanding its capacity for high-purity SiC substrates, which are foundational for downstream laser crystal fabrication.

Strategic opportunities are emerging through vertical integration, as laser system integrators seek to secure reliable access to SiC crystals and leverage proprietary doping and polishing processes for competitive differentiation. Notably, Coherent Corp.’s acquisition of laser substrate specialist II-VI signals a trend toward integrated supply chains, allowing for tighter quality control and accelerated innovation cycles.

However, significant disruption risks persist. The high capital intensity of SiC crystal growth infrastructure, coupled with technical barriers in scaling defect-free, large-diameter boules, may lead to supply bottlenecks—especially as new entrants attempt to penetrate the market. Geopolitical uncertainties and export controls around advanced material technologies further compound these risks, potentially impacting global supply dynamics.

To mitigate these challenges, companies are increasingly investing in automated monitoring systems and AI-driven process optimization. For example, HexaTech is leveraging in-situ diagnostics and data analytics to improve yield rates and reduce manufacturing variability. Such investments are expected to boost production efficiency and crystal quality, positioning leading players to capture growing demand in both legacy and emerging markets.

Looking ahead to the next few years, industry analysts anticipate that capacity expansions, process innovations, and strategic alliances will define the competitive landscape for SiC laser crystal manufacturing. Early adopters of vertically integrated, data-driven production models are expected to outpace competitors, while those unable to address scalability and supply chain robustness face heightened disruption risk.