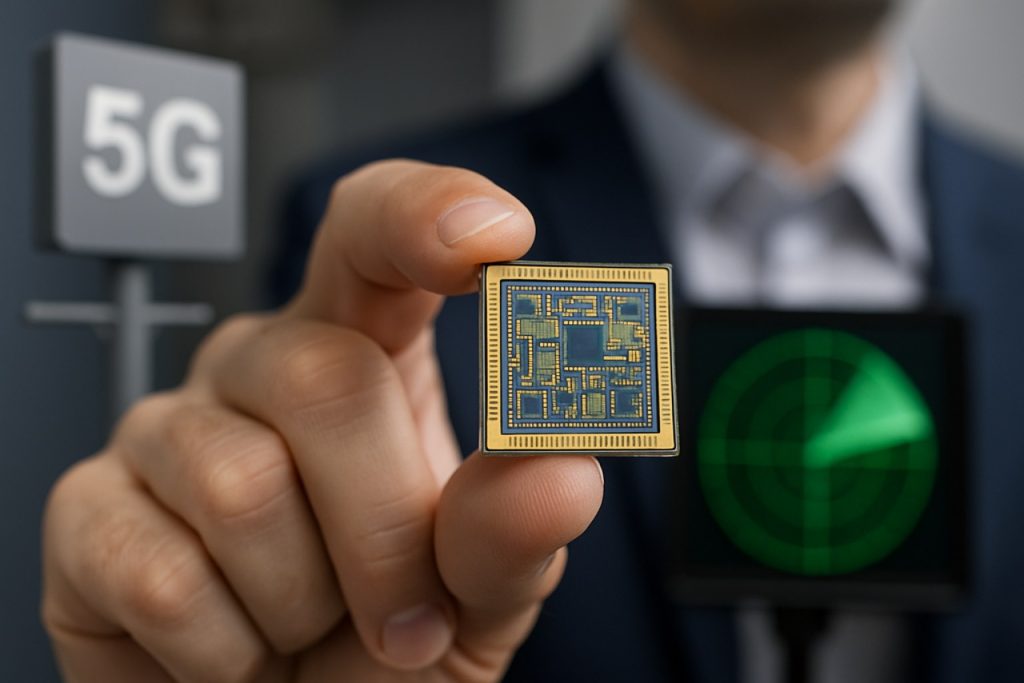

Monolithic Microwave Integrated Circuits (MMIC) Design Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights Shaping the Industry. Executive Summary & Market Overview Key Technology Trends in MMIC Design Competitive Landscape and Leading Players Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis Regional Market Analysis: North America, Europe,